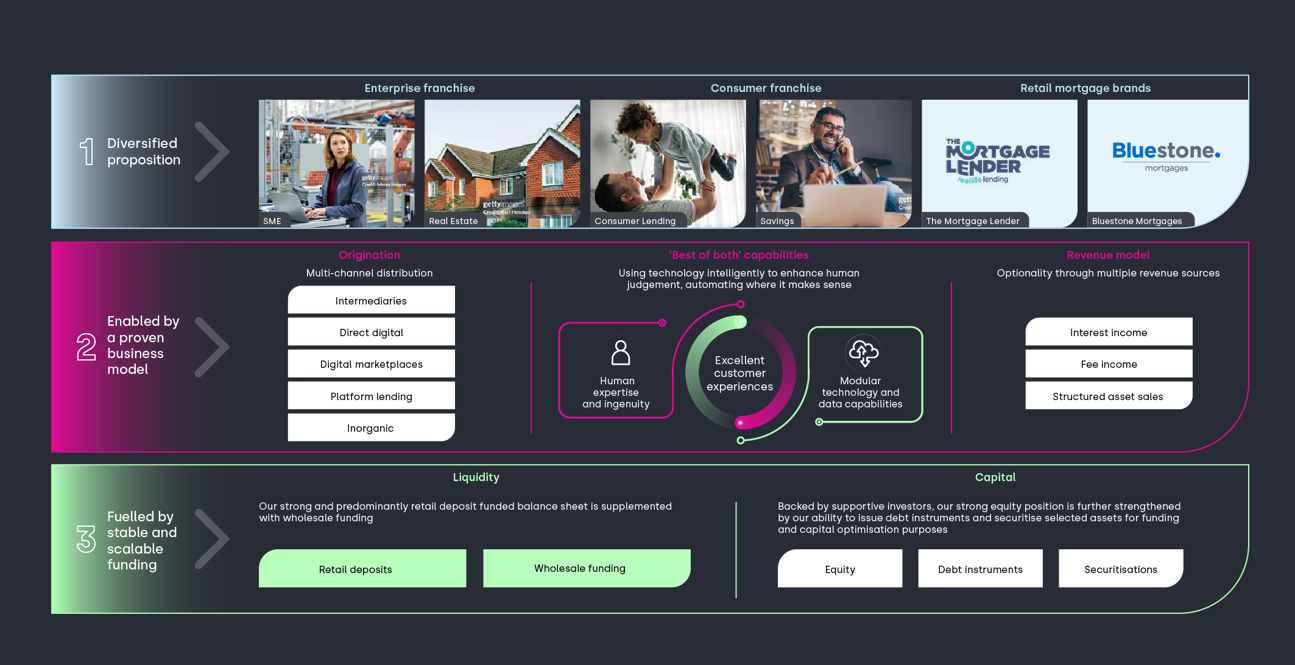

We use our ‘best of both’ proposition, to understand our customers’ individual requirements and deliver the right finance solutions seamlessly and at scale.

We embrace a multi-channel distribution model, which, coupled with our sophisticated approach to risk management and our digital capabilities, means we can act nimbly and resourcefully to meet the evolving needs of our customers.

Explore Investor Relations

Focussing on three strategic priorities

1 - Exceptional customer franchise

2 - Innovative mindset driving growth

3 - Robust and sustainable platform

Enterprise franchise

SME

Supports established and fast-growth UK SMEs with a range of debt-based financing solutions, deployed through the following business units:

Structured lending:

- Financial sponsors

- Speciality finance

- Specialist markets

- Corporate lending

- Development finance

Digital SME lending

Real Estate

Supports the UK property sector with a range diverse commercial and residential mortgage products offered to professional landlords and property investors.

-

- Buy-to-let

- Bridging finance

- Commercial investment

Consumer franchise

Consumer lending

Provides a range of secured and unsecured personal lending products to consumers for multiple purposes, distributed through a range of partners and direct through our digital proposition.

- Unsecured personal loans

- Motor finance

Savings

Provides a wide range of savings solutions with competitive interest rates, including easy access, notice and fixed term accounts as well as fixed and easy access cash ISAs.

- Personal savings

- Business savings

Retail Mortgage Brands

The Mortgage Lender Limited (TML) and Bluestone Mortgages Limited (BML)

Support customers with more complex income profiles, including the self-employed, entrepreneurs and first-time buyers with residential mortgage products, as well as UK landlords with a range of specialist buy-to-let mortgage products.

- Owner-occupied mortgages

- Buy-to-let

Our Business Model

The business model we have created is unique and difficult to replicate

Frequently asked questions

When is the next set of Financial Results being announced?

Please refer to the financial calendar for the dates of future announcements

How do I contact Shawbrook Group plc?

Please contact us using the following details:

By post:

Shawbrook Group plc

Lutea House

Warley Hill Business Park

The Drive

Great Warley

Brentwood

Essex

CM13 3BE

By email: companysecretary@shawbrook.co.uk

Our ESG strategy

Focusing on those areas in which we can deliver the greatest impact

Environment

We want to play our part in enabling a just transition1 to net zero by leveraging our insights and expertise

- Support the climate transition

- Reduce our climate impact

- Embed climate into our business DNA

Social

We want to boost social mobility, champion equality and diversity and create an inclusive environment for all by leveraging our capabilities, networks and people

- Support customers with specialist finance

- Attract and retain the best talent

- Give back to our communities

Governance

We are committed to operating under a robust governance framework which underpins our purpose and serves all of our stakeholders

- Effective Board and management structures

- Maintain robust governance and risk management

- Transparent and accountable disclosures

1 We use the term ‘just transition’ to describe applying a social lens to opportunities and risk arising from the climate transition, with the interests of employees, communities and customers in mind, to ensure it is fair and inclusive for all actors in society.

Our business

Investors

We provide finance to a range of customer segments that value the premium experience, flexibility and certainty we deliver. Our ambition is to deliver for more customers in more markets. We will do this by combining the innovative mindset and agility of a start-up with the scale and financial strength of a large business.

About Shawbrook

Shawbrook provides finance to a wide range of customers who value the premium experience, flexibility and certainty we deliver. We are a purpose-led organisation, with a focus on delivering long-term sustainable value for all our stakeholders.

Sustainability

Our sustainability strategy is designed to create value for our customers, colleagues, communities, suppliers and shareholders, while having a positive impact on society and the wider environment.